Gallery

Images by Michael Seto Photography

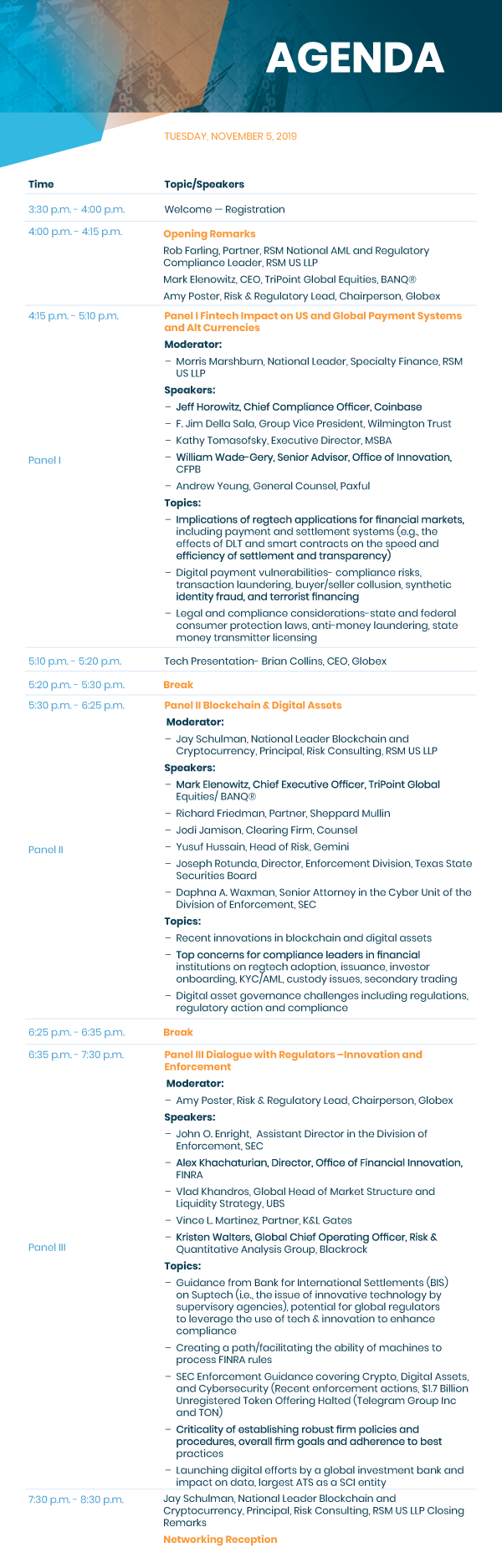

Dialogue with the Regulators: Navigating Blockchain & Fintech unlocks the critical partnerships between the financial services industry, solution providers, key industry leaders, and regulators leveraging technology to drive innovation and regulatory change.

At the forefront of revolutionary changes in fintech and regtech is blockchain technology. Worldwide spending on blockchain solutions alone is expected to grow from $1.5 billion in 2018 to an estimated $11.7 billion by 2022 with the financial sector accounting for over 60 percent of the market value of blockchain worldwide (Statista). As overall fintech solutions evolve, the regulatory landscape will face enormous challenges in keeping up with technology disruption.

The forum brought together the fintech ecosystem for an intimate and productive dialogue focused on collaborative and innovative approaches towards building a robust financial and regulatory compliant environment.

Risk and Regulatory Lead

Horizon

Assistant Director in the Division of Enforcement.

Senior Attorney in the Division of Enforcement

Director in FINRA’s Office of Financial Innovation (OFI)

Senior Advisor in the Office of Innovation

CEO TriPoint Global Equities

TriPoint Global Equities

Director, Risk Consulting

RSM US LLP

Partner

Sheppard Mullin

Chief Compliance Officer

Coinbase

Head of Risk

Gemini

Chief Regulatory Officer

ETC

Global Head of Market Structure and Liquidity Strategy

UBS

National Leader, Specialty Finance

RSM

Partner

K&L Gates

Director, Enforcement Division

Texas State Securities Board

Group Vice President

Wilmington Trust

Principal, Risk Consulting

RSM

Executive Director

MSBA

Global Chief Operating Officer of BlackRock's Risk & Quantitative Analysis Group

Blackrock

General Counsel Paxful

Paxful